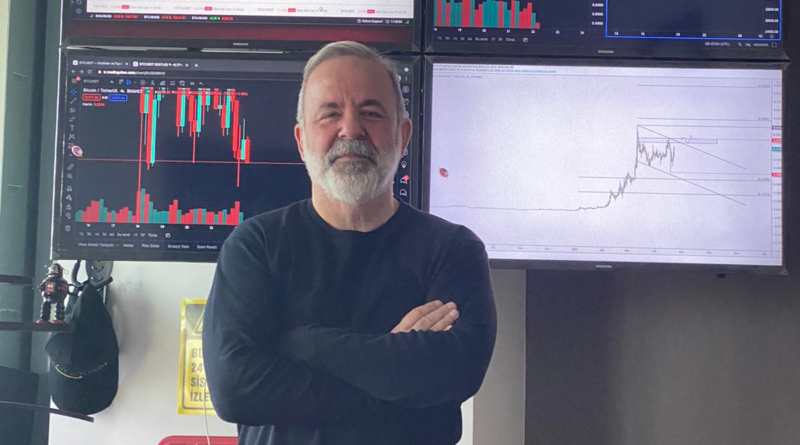

BLOCKCHAINARMY FOUNDER PRESIDENT EROL USER SHARES HIS OPINION ON CHALLENGES & PROSPECTS OF CENTRAL BANK DIGITAL CURRENCIES

We expect central bank digital currencies (CBDC) to gain further momentum. This will likely be driven first and foremost by China, which is advancing quickly with its digital yuan pilot projects.However, the digital yuan can only be a competitive tool for China if authorities are willing to grant more anonymity than they may be inclined to offer. Furthermore, the rise of the digital yuan is likely to increase regulatory risk for all crypto currencies.

Crypto currencies have dominated headlines in financial markets in early 2021, especially the inexorable rise of Bitcoin. However, 2021 is shaping up to be not only a banner year for crypto currencies, but also a breakout year for central bank digital currencies (CBDC). Such currencies are likely to be at least as relevant for our economic future as crypto currencies may turn out to be. Furthermore, the rise of CBDCs may increase the potential for increased government restrictions on crypto currencies.

CBDCs have been discussed for several years now across multiple countries and with varying intensity. While inspired by the rise of crypto currencies, CBDCs are different in that they are legal tender, guaranteed by the respective governments. They are also not necessarily using blockchain technology for their implementation.

While several governments have experimented with CBDCs, at this stage the People’s Bank of China (PBoC) is arguably the market leader. China last year took a very important step forward in the implementation of a digital yuan in the shape of its DCEP project (Digital Currency Electronic Payment). DCEP is the only legal digital currency in China. DCEP relies on a two-tier infrastructure, whereby commercial banks (as well as non-banks such as Alibaba and Tencent) act as intermediaries between end-users and the central bank. Importantly, the digital yuan is not a decentralized crypto currency, but is run on a centralized network controlled by the PBoC. It therefore does not offer guaranteed anonymity. Since April 2020, the digital yuan has been tested in four large Chinese cities. Government workers in Sozhou have received part of their wages in DCEP, Shenzen handed out DCEP to lottery winners, and merchants who accept any digital payments must, by law, also accept DCEP. The PBoC’s goals are ambitious. The Chinese authorities aim to broaden the roll-out to make DCEP more widely usable in time for the 2022 Winter Olympics. A further 28 cities, including Shanghai and Beijing, are slated to take part in a future phase. Hong Kong is also taking part in a pilot project for cross-border payments in DCEP.

That China’s central bank is an early mover on the digital currency front is not a coincidence. The adoption of e-payments in China has been very rapid compared to most other countries. This was largely driven by the success of Tencent’s WeChatPay (the fintech tool residing inside WeChat) on the one hand and of AliPay on the other. It is plausible that the decision to create a CBDC was a direct response to the powerful positon of these companies in the Chinese economy. Offshore, the announcement of the Libra digital currency by Facebook may also have focused minds in Beijing. The ambitions and early successes of the private sector with respect to digital currencies increased the pressure on the Chinese government to provide its own solution to the demand for digital cash, not least in order to keep seigniorage revenues from disappearing.

The digital yuan is not just a defensive move by the Chinese government. A digital yuan is very attractive to the government for several reasons. First and foremost, it helps the government with the macroeconomic management of the economy. Chinese policy makers have always aimed to operate with a scalpel rather than with a hammer. For example, the government prefers credit extension rather than interest rate cuts as its prime tool to manage demand, as has also been evident during the Covid-19 pandemic. When interest rate cuts have been made in the past, they were often geared towards specific industries rather than broad cuts that benefit the whole economy. The digital yuan is therefore the next logical step in this policy, handing the authorities a laser, which they hope will further improve on the precision of a scalpel.

“With a digital yuan, fiscal policy can be targeted directly to groups and causes that the government considers to be deserving.”

Restrictions on what that support could be spent on could also be implemented. Laser-like fiscal policy, indeed.

The desire for control may be as important a motivation as improved macro management. Increasing control over the payments system could, for example, be used to sharply restrict offshore payments. With the authorities in theory being able to see every transaction that utilizes DCEP, it would be quite easy to limit such capital flight. And capital flight has been an Achilles heel of the Chinese economy in the past. For example, following the CNY depreciation in 2015, China lost around USD1trn in reserves, as the old-style capital controls were not sufficiently tight. A digital yuan would almost certainly avoid a replay of the 2015 experience in the event of a similar crisis. The extent to which offshore payments can be prohibited could easily vary over time, depending on the needs of the Chinese economy. Other undesirable uses of money could also be blocked, be it linked to crime or to corruption, which has been another target of the Chinese government in recent years.

Lastly, a digital yuan may also benefit the Chinese government’s ambition for the yuan to gain market share from the USD. Clearly, the Trump administration’s use of the USD as a foreign policy weapon set alarm bells ringing across the world, and in particular in China. The current move towards the internationalization of the CNY is already making the CNY more competitive, but the bulk of international settlements is still taking place through CHIPS or SWIFT. The former is a US company and the latter has a majority of board members from the US or its allies.

“A digital currency infrastructure would help China to avoid this dependency on the US.”

Furthermore, being an early mover towards a digital currency may be helpful in the effort to gain market share from the USD to the extent that it makes payments more efficient and cheaper. The goal to offer a competitor to the USD requires setting up an international infrastructure for the digital CNY. It is therefore no coincidence that Beijing has recently joined the Multiple Central Bank Digital Currency Bridge, a cross-border payments project initiated by the HKMA and the Bank of Thailand in 2019. Of course, how successful this campaign likely will be depends to some extent on how much anonymity China is willing to grant. There may be a trade-off between the desire for control and the desire to internationalize the digital CNY. Without some level of anonymity, the digital yuan is unlikely to help in the quest to internationalize the CNY.

Another reason that has been advanced for the creation of DCEP is that it will allow authorities to set negative interest rates. For China, at this stage this is unlikely to be a major motivation. After all, China has used the interest rate tool quite sparingly and is not at risk to hit the zero bound any time soon. However, Chinese policy makers are noteworthy for being forward looking, and with a quickly aging society, a continued downward drift of interest rates over the next decades is plausible. As such, China may well find that negative interest rates will eventually become a useful tool to manage its economy.

What about other countries? Richer countries have, in general, less to gain and more to lose from a speedy introduction of CBDC. While the Biden administration may be more open to a FedCoin than its predecessor, we do not expect the US to be an early mover.

“Gains from increased financial inclusion and general efficiency gains for the payment systems are likely lower in many of the richer countries.”

And risks from undermining the banking system with an ill-designed CDBC may be larger in those countries, too. A wide-scale implementation in the US or Europe therefore appears unlikely, with Sweden and South Korea, which are already running retail CBDC projects, being possible exceptions. But countries like Russia seem more likely to quickly follow in China’s footsteps, and discussions there are relatively far advanced.

Of course, as has become clear from the motivations for China’s CBDC discussed above, crypto currencies are diametrically opposed to what Chinese policy makers have in mind. The fact that crypto currencies guarantee anonymity likely means they would undermine any gains in the fight against capital flight or corruption that the digital yuan may otherwise achieve. It would also be much harder to implement negative interest rates when crypto currencies offer a zero interest rate alternative. In addition, the more heavy handed the control over the CBDC would be, and the more likely negative interest rates appear, the quicker the population is likely to adopt crypto currencies. Of course, the authorities are fully cognizant of that. And this may explain the hostility of Chinese policy makers towards crypto currencies. China has already outlawed coin offerings, as well as crypto exchanges, though it is at this stage still allowing crypto mining. But, the closer we get to the broad launch of the digital yuan, the more likely is a more serious government clamp down on crypto currencies. While 2021 has started with much momentum for crypto currencies, momentum for CBDC is likely to rise, and may become an important source of risk for crypto.