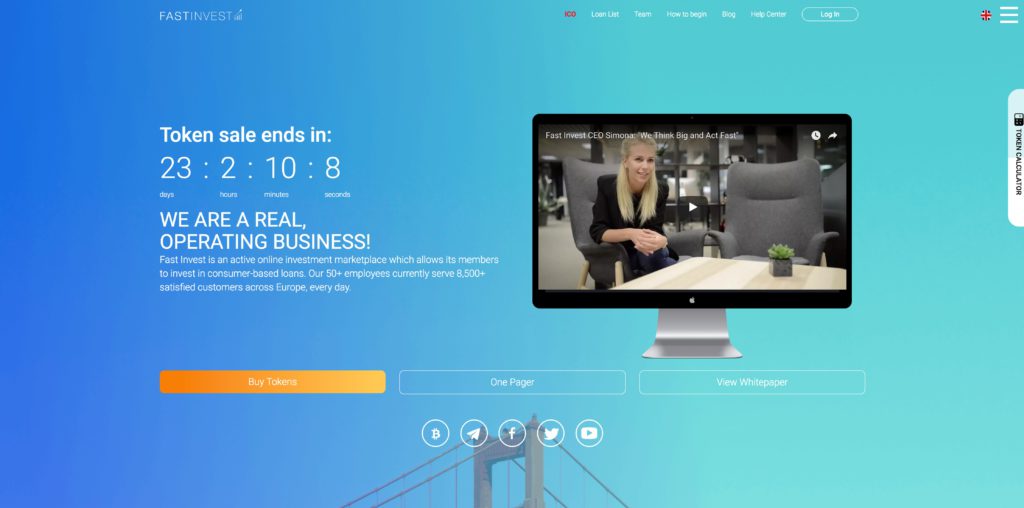

Simona Vaitkune: FAST INVEST P2P Investment Loan Platform Enters Blockchain Sector with ICO Launch

Fast Invest is excited to announce the launch of its native cryptocurrency token (FIT) during their

Fast Invest is excited to announce the launch of its native cryptocurrency token (FIT) during their

upcoming ICO on December 4th. The FinTech company has been operating since 2015 in the

investment loan space, connecting funders with loan-seekers in a peer-to-peer exchange. With

more than 8,500 daily users from 36 countries, Fast Invest is expanding into the largely

unoccupied cryptocurrency lending sector.

Blockchain-based cryptocurrencies have been rapidly in 2017, racking up a seventeen times (at

the time of this press release) increase in market capitalization since the beginning of 2017. As

these financial technologies mature new opportunities arise, especially for unbanked and

underbanked populations. This is because digital currencies allow for the exchange of value

without the need for central banks or other intermediaries. Fast Invest aims to leverage these

developments to democratize investment by allowing people to invest as little as one dollar on their

loan platform. This enables users to band together to crowdfund a loan that gets paid back with

interest, which can then generate returns for the loan suppliers.

In what may be a first for the industry, Fast Invest will allow users to use their bitcoin or ethereum

as collateral for loans in traditional currencies. Due to the nature of smart contracts, loans like this

can be executed with very little human input and all parties can be sure that the terms of the loan

will be carried out. This is because smart contracts utilize code and mathematics to enforce

agreements without the need for human intervention.

By expanding to cryptocurrency-based investment instruments the company aims to reduce friction

in the world of P2P investment and loan services. These offerings include a cryptocurrency

exchange, digital wallet for holding tokens, cryptocurrency investment services, decentralized

lending, and a payment card that can be funded by cryptocurrencies but used like a credit card.

CEO Simona Vaitkune had this to say:

“From the very beginning our mission is to help people generate secure and stable passive income

stream and achieve their financial freedom. I am delighted that we are expanding our platform to a

new infrastructure of the blockchain. This will enable our customers use both fiat and crypto

currencies for daily banking operations. The future of digital banking is almost here and we are

ready to meet it.”

More information about our platform and current ICO:

Summary: FAST INVEST is the successfully operating business. Since 2015 team of dedicated specialist are developing powerful investment platform that is based on investing in consumer loans across Europe and globally. The company is expanding and building new infrastructure on the blockchain to offer new digital banking products. Fast Invest will merge fiat and cryptocurrencies and enable users to use both for their daily banking operations. Lending, borrowing, investing, payments - our day-to-day banking habits avoiding the convoluted bureaucracy.

P2P Investment Loan Platform Enters Blockchain Sector with ICO Launch