Senate Confirms Selig and Hill; CFTC Left With “Sole Commissioner” Power Vacuum

Senate confirms Michael Selig (CFTC) and Travis Hill (FDIC) in a 53-43 vote, leaving the CFTC with a rare ‘sole commissioner’ structure and signaling the end of crypto debanking.

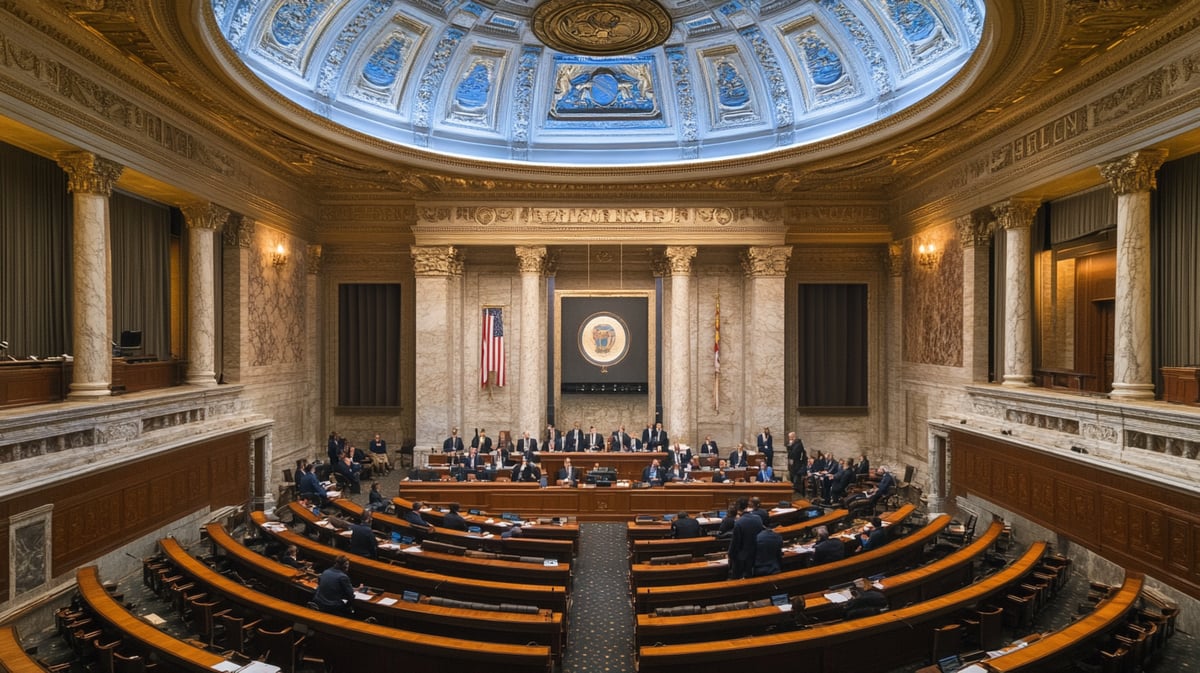

The US Senate confirmed Michael Selig as Chairman of the Commodity Futures Trading Commission (CFTC) and Travis Hill as Chairman of the FDIC late Thursday, officially ending the “regulation by enforcement” era. The 53-43 party-line vote installs two vocal crypto proponents at the top of America’s financial stack, effective immediately.

The Receipt

Confirmed in a Senate roll call Thursday, Selig takes the helm of the derivatives regulator under unprecedented circumstances. With the resignation of Acting Chair Caroline Pham, Selig will sit as the agency’s sole commissioner. A bureaucratic anomaly that grants him unilateral authority until further nominees are confirmed.

Selig, a former Willkie Farr & Gallagher partner and SEC Crypto Task Force counsel, has pledged to apply the “minimum effective dose of regulation.” His confirmation triggers an immediate pivot for the CFTC, which is now expected to accelerate its “Crypto Sprint” initiative to integrate digital asset spot markets under its oversight.

Selig’s experience in crypto and as a federal regulator will ensure that America’s crypto market is governed with fairness, clarity and an abiding commitment to the law. — Faryar Shirzad, Chief Policy Officer at Coinbase

Institutional Context: The Banking Pivot

While Selig captures the headlines, Travis Hill’s confirmation at the FDIC signals a deeper structural shift for crypto banking. Hill, previously Vice Chairman, has been a vocal critic of “Operation Choke Point 2.0,” the informal pressure campaign that cut crypto firms off from the banking system in 2023-2024.

Hill is expected to immediately rescind prior guidance that restricted banks from holding stablecoin reserves, a move likely to reopen correspondent banking rails for issuers like Circle and Paxos. The confirmation comes as Bitcoin holds near $87,000, stabilizing after a week of volatility driven by liquidation cascades.

What’s Next

With Selig operating as a one-man commission, rule-making speed will increase, but durability concerns remain. Industry observers expect the CFTC to prioritize a new framework for tokenized collateral in derivatives markets before Q2 2026.